Earn APY* with an Openbank High Yield Savings account

- A Top-tier rate from one of the world's largest banks

- FDIC insured

- No fees

Rates 10x the national average† and the bonus of a better banking experience.

FDIC insured

Making money is great. Having the peace of mind of being federally insured is even better.

Top-tier rate

Watch your money grow faster with rates 10x the national average§.

No fees

With no hidden charges or fees, your money stays where it belongs: in your pocket.

Savings that make more savings

High rate, higher return. Your money grows faster with Openbank's High Yield Savings account with 10x the national average APY.

A minimum deposit of $500 is required to open an account.

The Openbank High Yield Savings account comes with high ratings.

Openbank High Yield Savings received a rating of 4.7/5 stars from Bankrate and a rating of 4.9/5 stars from NerdWallet.

Still on the fence? Here are a few more reasons to choose Openbank.

Open in just 5 minutes

Because making money work hard should be easy.

Industry-leading security

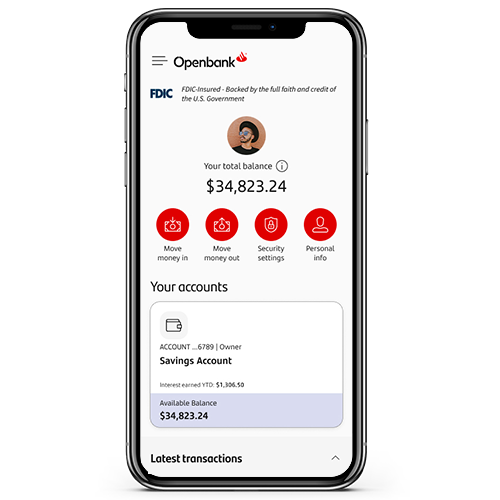

Openbank goes above and beyond with trusted device verification – so your face or your fingerprint is the key to your account.

Help from real people

Our app makes digital banking feel natural and intuitive – and if you need support, click-to-call makes it easy to get real help from a real person.

You can get started in less than 5 minutes. (Really. It's that easy.)

Helpful resources

What is a High Yield Savings Account?

When you’re looking to boost your savings or emergency fund, a high yield savings account may be the perfect way to do it.

How Do High Yield Savings Accounts Work?

A high yield savings account (HYSA) pays a higher interest rate compared to traditional savings accounts.

Are High Yield Savings Accounts Safe?

High yield savings accounts (HYSAs) are a popular alternative to traditional savings accounts, and for good reason.

Common questions about High Yield Savings Accounts

High-yield savings accounts are interest-bearing savings accounts that can offer higher interest rates than the national average of standard savings accounts. They’re also FDIC-insured, if held at a member institution.

Openbank is a part of Santander Bank, N.A., which is a member institution of FDIC. As a result, our High Yield Savings accounts are FDIC insured up to the standard maximum deposit insurance amount of $250,000 per depositor, per ownership category. Deposits at Santander Bank and its Openbank division are combined for FDIC purposes and are not separately insured. For more information about FDIC deposit insurance, visit the FDIC’s online resources here.

Learn more about what a high-yield savings account is.

As explained in the Openbank by Santander Personal Deposit Account Agreement, please note that High Yield Savings accounts at Openbank are intended for accumulating savings and therefore do not include checks or debit card functionality.

In order to qualify:

- You must be at least 18 years old

- You must have an active U.S. mobile phone number

- You must have a smartphone on which you can download and use the Openbank app – you'll be prompted to set this up as your trusted mobile device

- You must be a U.S. Citizen or U.S. Resident Alien with a valid U.S. residential address

- Your home ZIP Code must be within Openbank’s current service area, which is every state in the U.S. and the District of Columbia

To add a joint account owner to your Openbank account:

- Sign in to the Openbank app on your trusted mobile device. If you’re using online banking, you’ll need your trusted mobile device to verify your identity.

- Go to the Account information page and select More options. You can also go to your Account transactions and view the available actions.

- Select Add an account owner.

- Follow the instructions to send an invitation to the person you’d like to join your account.

Visit openbank.us and select Open savings account on the home page. You can also open an account using Openbank’s mobile banking app, which is available for free on the App Store® or Google Play.

To open an account, you’ll need to:

- Make a minimum initial deposit of $500

- Be at least 18 years old

- Have a U.S. mobile phone number

- Download the Openbank app onto a smartphone, which will become your trusted mobile device

- Be a U.S. Citizen or a U.S. Resident Alien with a valid residential address within our current service area (which is every state in the U.S. and the District of Columbia)

*Interest Rates and Annual Percentage Yields (APYs) shown are accurate and effective as of 12:01 AM Eastern Time today. The products and rates we offer may vary between locations, are available in select markets only, and are subject to change without notice. Availability and rate for this product will be based on the residential ZIP code entered when account is opened within online application process. This is a variable-rate account and the rate applicable may change at our discretion any time without notice. Fees may reduce earnings. A minimum deposit of $500 is required to open an Openbank High Yield Savings account. Personal accounts only. For more information about applicable fees and terms, refer to the Personal Deposit Account Fee Schedule.

†The comparison is based upon the national average for Savings deposit products as published in the FDIC National Rates and Rate Caps on FDIC.gov of 0.39%, accurate as of February 17, 2026.

For more information, refer to the Personal Deposit Account Fee Schedule.

There is a maximum of $250,000 of deposit insurance from the FDIC per depositor for each category of account ownership. Please visit FDIC.gov for details. Deposits at Santander Bank, N.A. and Openbank are combined for the purposes of calculating FDIC insurance limits (FDIC Cert #29950) and are not separately insured.

@2026 Bankrate, LLC. A Red Ventures company. All Rights Reserved. Bankrate scores are objectively determined by its editorial team. Annual percentage yields (APYs), minimum opening deposit requirements and minimum balances to avoid monthly service fees are some of the things that make up Bankrate’s score.

©2014-2026 and TM, NerdWallet, Inc. All Rights Reserved. NerdWallet’s ratings are determined by its editorial team. The scoring formulas take into account multiple data points for each financial product and service.

App Store is a registered trademark of Apple Inc. Google Play is a trademark of Google, LLC.